cash tax refund check with two names

Answer 1 of 4. A good number of banks require both parties on the account.

Get Our Example Of Direct Deposit Payroll Authorization Form Payroll Legal Questions Being A Landlord

If you no longer have access to a copy of the check call the IRS toll-free at 800-829-1040 individual or 800-829-4933 business see telephone and local assistance for hours of operation and explain to the.

. Two-party checks are made out to Party A and Party B or Party A or Party B Note that there is a major difference between the two. Sure they can take ID and accept the endorsement of spouse not on account. Form 8888 is not required if you want IRS to direct deposit your refund into.

I endorsed the check. We might be talking about a 400 check or a 40000 check and the personal representative might take a dim view of the IRS declaring a right of. Call the bank if you have any questions.

If the check was written in a confusing manner or youre not sure where to cash it reach out to the bank. The bank will not accept the check without my wifes signature. Up to 2 cash back Check cashing fees start at 3 with Shoppers Card for checks up to 2000.

Most of the year the limit on check cashing is 5000 but from January to April during prime tax refund season the limit rises to 7500. When I first looked at the check I noticed it had a symbol followed by my mothers name on the line below the one with my name. If you receive such a check you can tell how to deposit it at Advantis by noting how both names are written in the Payable To line.

If you are unavailable to sign its possible for your account co-owner to deposit the check into the account with just one signature and withdraw cash at an ATM. Im pretty certain this is in the 24 category. I received my US federal tax return earlier this month.

Its important to guard your information carefully to avoid losing your refund. Cashing a check with two names on it can be done in one of two main different ways depending on how the names are written out. Imposes a 4 fee on all transactions up to 1000 and 8 for transactions above that amount.

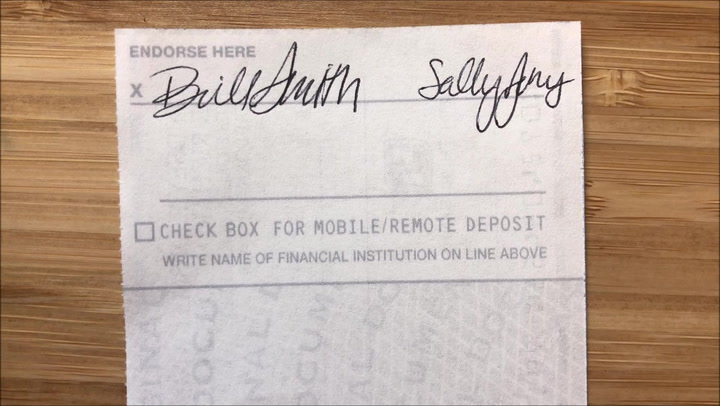

If the names are separated by the words or or andor or by a comma or if. Splitting your refund is easy and can be done electronically if you use IRS Free File or other tax software. When a check is payable to two parties the cashing of the check is more difficult.

When I went cash the check my bank said that my spouse need to be present before I can cash the check. The rules are generally the same across most of the top US. If your refund is issued.

If the issuer of the check lists the names with the word or in between them or the names are listed separately one to each line then either person may cash the check. But the problem is that my spouse live in overseas. I need Survivors Affidavit form DTF-280.

The location is based on the city possibly abbreviated on the bottom text line in front of the words TAX REFUND on your refund check. For example the Walmart check cashing policy in Texas and elsewhere in the US. In doing so they might be accused of allowing the account holder of.

Banks with a few additional requirements by some banks. The process is not complex and is the same for all types of checks written to you. Youll need to sign the check over to your relative by endorsing the back and writing the words Pay.

Basically when you deposit a check written to multiple payees all payees must. Get Help from a Relative. And a request that IRS to reissue the check in the name of the survivor.

This is useful to place money into checking savings and even an. Read the teller the information on the pay to line to find out if the other person needs to be there when you cash the check. You might not be able to.

I amended my 2016 tax return to married filing jointly and the refund check is issued with both spouse name on it. You can sign a federal tax refund check over to a family member to be cashed or deposited into his account. She cannot sign from the grave.

Call your bank to find out what requirements the bank has for cashing joint tax refunds. Tax Refund Check Payable to Deceased Person - 121504 0628 PM. In such cases you can embrace the check to the individual similarly as you would with some other check so the individual can cash it.

Method 3Overcoming Roadblocks. Please help me on that because my spouse. Many banks require both parties on the check to be co-owners of a joint bank account.

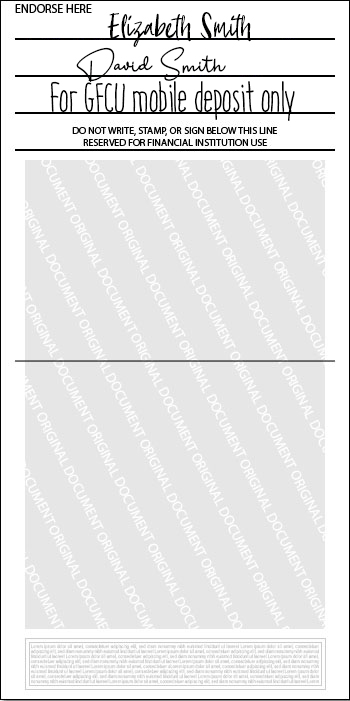

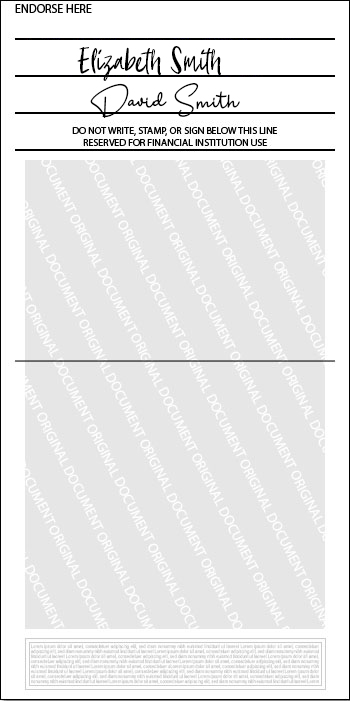

However if it is addressed to your spouse and or you as is the case with a federal tax refund both parties must cash or. Now that tax season has officially begun some Advantis members may receive tax refund checks from the IRS made out to two names. If a check with two names says and on the pay to the order of line then everyone has to endorse the check.

You can have someone else cash your refund check if you follow regular banking policies. If you file a paper return use Form 8888 Allocation of Refund Including Savings Bond Purchases to split your refund among two or three different accounts. Most of the year the limit on check cashing is 5000 but from January to April during prime tax refund season the limit rises to 7500.

For refunds issued during the second quarter which ended June 30 the IRS will pay 5 interest compounded daily. Post by Deleted onJun 13 2013 at 805pm. The answer was yes they will cash a check with 2 names with only 1 signature.

If the refund check is addressed to you or your spouse or if there is a between the names then your spouse can sign and cash it alone or deposit the joint tax refund check into an individual account. Tax Refund Check Payable to Deceased Person - 121504 0628 PM. If only one person has an individual account the bank may require both you and your spouse to visit the bank to endorse the check.

Certain circumstances may make you have someone else cash your refund check for example when an individual record isnt right now accessible or when you have guaranteed the check as installment or a blessing. However anyone can attempt to duplicate these steps if your check falls into the wrong hands. Also we dont have a jointly bank account.

I didnt think much of it until I tried to cash the check at Walmart and. Odd so I called my mother that evening and she agreed that It was strange. Im pretty certain this is in the 24.

You can also request that your refund direct deposit be split among up to three different accounts. Depending on the banks policy it might require the check to clear before your relative can access the funds. New York sent a refund check made out to my deceased wife and me.

Tax Filing Season Kicks Off Here S How To Get A Faster Refund

Joint Check Agreement Form Within Joint Check Agreement Template 10 Professional Templates Email Template Business Business Plan Template Contract Template

Stimulus Payments Find Tax Info You Need To See If You Get More Cnet

Best Representation Descriptions Does Walmart Cash Cashiers Checks Related Searches Auto Insurance Claim C Credit Card Design Money Template Payroll Template

/cloudfront-us-east-1.images.arcpublishing.com/gray/L6QOIUO7NRFJ3ENZ4A52GTLCKU.bmp)

Don T Toss These 2 Important Stimulus And Child Tax Credit Letters From The Irs

Tips For Depositing Your Government Issued Stimulus Or Tax Refund Check Greenville Federal Credit Union

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

Tips For Depositing Your Government Issued Stimulus Or Tax Refund Check Greenville Federal Credit Union

What Is Partnership Agreement Template A Partnership Is A Business Formed With Two Or More People Each Indivi Contract Template Agreement General Partnership

How To Cash A Two Party Check Without The Other Person With One Signature Etc First Quarter Finance

Which Table Do You Relate To Money Management Advice Money Saving Strategies Budgeting Money

What Is A Two Party Check Where Can You Cash It Mybanktracker

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Tax Refunds How To Check Your Stimulus Payments History In 2022 Irs Taxes Income Tax Return Tax Refund

How To Cash A Two Party Check Without The Other Person With One Signature Etc First Quarter Finance

Direct Deposit Form Template Word Sample Direct Deposit Form 8 Download Free Documents In Form Example Letter Templates Templates

How To Cash A Two Party Check Without The Other Person Expert Tips